Latest Requirements for AMS Declarations on Imported Goods to the USA in 2026

With the increasing demands for import security and supply chain transparency in the United States, the Automated Manifest System (AMS) is becoming increasingly important in the customs clearance process. Entering 2026, the U.S. Customs and Border Protection (CBP) has imposed higher requirements on the accuracy, timeliness, and consistency of AMS declarations. For companies exporting goods from China to the United States, understanding and strictly adhering to AMS rules has become a crucial prerequisite for avoiding inspections and penalties.

What is AMS filing?

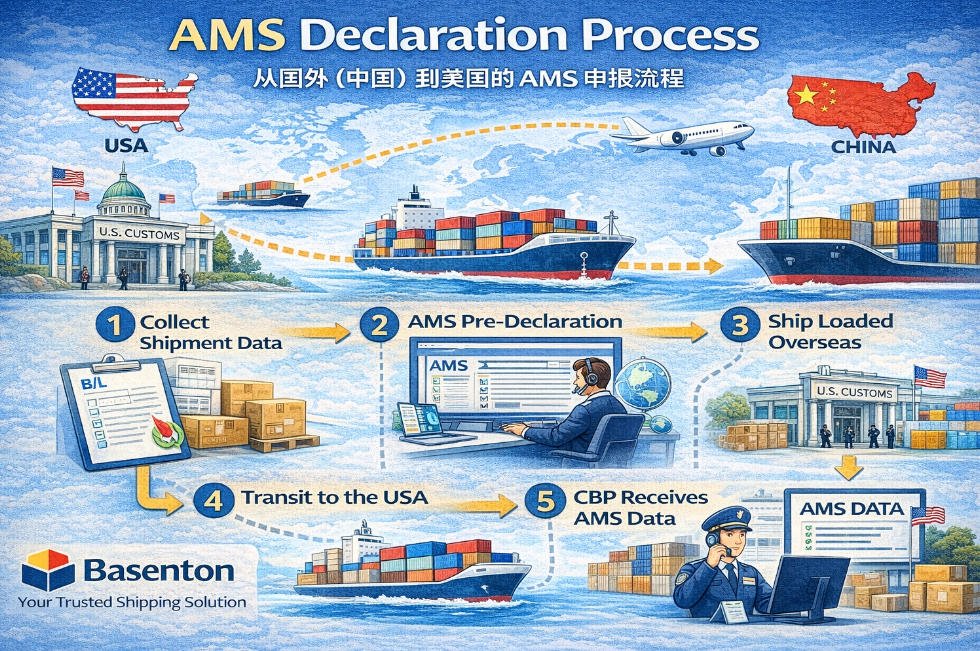

AMS is an electronic filing system used by U.S. Customs to obtain advance information on imported cargo shipments. Through AMS, CBP can assess the cargo, security risks, and compliance before the goods arrive in the United States.

AMS is not a “post-arrival declaration” procedure; it must be completed before the cargo is loaded onto the vessel or aircraft. If the information is incomplete or the declaration is incorrect, the cargo may be flagged as high-risk even if it is already in transit.

In the U.S. import system, AMS is a crucial component of 10+2 (ISF), manifest filing, and security screening, and these elements are highly interconnected.

Trends in Core Requirements for AMS Filings in 2026

Based on enforcement trends in recent years, the changes to AMS requirements in 2026 are not a “major overhaul of the rules,” but rather a move towards stricter enforcement and lower tolerance for errors.

Firstly, U.S. Customs is placing greater emphasis on the consistency of declared information. The product name, HS code, quantity, weight, and consignor/consignee information in the AMS filing must be highly consistent with the bill of lading, commercial invoice, and packing list.

Secondly, tolerance for “vague descriptions” continues to decrease. General descriptions such as “general cargo,” “accessories,” and “parts” are increasingly likely to trigger system alerts.

Finally, penalties for late or incomplete AMS filings are being enforced more strictly, leading to a significant increase in fines and the risk of port delays.

Main Information Content of an AMS Declaration

A complete AMS declaration typically includes the following key information:

- Complete information of the shipper and consignee

- Accurate English description of the goods (including product use)

- HS Code (preferably 6 digits or more)

- Number of packages, weight, and packaging type

- Port of origin and port of destination

- Bill of lading number and mode of transport

Among these, the English description of the goods and the HS Code are the most common areas for errors and are also key areas of focus for CBP risk assessment.

China is one of the main sources of imports for the United States, therefore goods from China are usually subject to “high scrutiny” during AMS (Automated Manifest System) review.

In practice, the AMS risks for shipments from China to the US mainly focus on the following aspects:

- Product descriptions are too simple, making it difficult to accurately determine the nature of the goods;

- Declared value does not match the product type;

- Inconsistent declaration information for multiple shipments from the same shipper.

For cross-border e-commerce, FBA (Fulfillment by Amazon) shipments, or DDP (Delivered Duty Paid) shipments, AMS filing is often handled by freight forwarders, but the cargo owner is still responsible for the accuracy of the source information.

You might also be interested in:

AMS Filing Deadline and Time Rules

Timely submission of AMS filings is one of the most crucial aspects of the entire process. Adhering to filing deadlines is essential to ensure compliance and prevent shipping delays.

Sea Freight

For sea freight shipments, AMS data must be submitted at least 24 hours before the cargo arrives at the foreign port. Failure to submit AMS data within this timeframe may result in customs clearance delays, leading to costly operational losses.

Air Freight

Air freight shipments typically have shorter lead times, depending on flight schedules. The specific AMS submission deadline will vary, but the time requirements for air freight are generally more stringent than for sea freight.

The Relationship Between AMS and ISF (10+2)

Many importers easily confuse AMS and ISF. Simply put, AMS is the Automated Manifest System, while ISF is the Importer Security Filing system. The two are related, but the responsible parties are different.

AMS is usually filed by the carrier or freight forwarder;

ISF is the responsibility of the importer or their freight forwarder.

If the AMS information is incorrect, it can directly affect the accuracy of the ISF, leading to double compliance risks.

Consequences of AMS Filing Errors

In the regulatory environment of 2026, AMS filing errors are no longer just a “low-probability problem.”

Common consequences include:

- Goods being flagged as high-risk, leading to increased inspection probability

- Delays at ports or warehouses, resulting in additional costs

- CBP fines (per shipment or per violation)

- Impact on the importer’s long-term compliance record

For companies that continuously import from China, a good compliance record itself has become a kind of “hidden cost.”

Why is it more important to choose a professional freight forwarder to handle AMS filings?

While AMS filing may seem like simple data entry, it actually involves U.S. Customs risk models, trade compliance, and transportation coordination. Inexperienced handling can easily lead to a chain reaction of problems due to seemingly minor details.

Professional freight forwarders typically perform the following before shipment:

- Verify cargo descriptions and HS codes

- Ensure consistency between AMS and bill of lading information

- Identify high-risk categories or sensitive descriptions in advance

- Verify compliance with ISF filing logic

This proactive review is often more valuable than attempting to fix problems after the fact.

This article was compiled by Basenton Logistics and first published on its website. Please indicate the source as Basenton when reproducing or copying this information on other websites.

Freight forwarders from China to the United States

Entering 2026, the US will only increase its demands for transparency and security scrutiny of import data. AMS filing is no longer a mere “formal process,” but a crucial component of the US Customs risk assessment system.

For companies exporting from China to the US, understanding the rules in advance, preparing accurate information, and collaborating with experienced freight forwarding companies is the best way to avoid unnecessary risks.

As a local Chinese freight forwarding company, Basenton Logistics has extensive experience in sea and air freight services from China to the US. During the actual transportation process, Basenton proactively intervenes in AMS information review during the booking and documentation stages, helping clients reduce customs clearance risks caused by declaration issues.

Through continuous monitoring of US-China shipping routes, product categories, and US customs requirements, Basenton can assist clients in controlling logistics costs while improving the overall controllability of transportation and customs clearance.

News

Berita Teknologi

Berita Olahraga

Sports news

sports

Motivation

football prediction

technology

Berita Technologi

Berita Terkini

Tempat Wisata

News Flash

Football

Gaming

Game News

Gamers

Jasa Artikel

Jasa Backlink

Agen234

Agen234

Agen234

Resep

Cek Ongkir Cargo

Download Film